estate and gift tax exemption sunset

Find some of the more common questions dealing with basic estate tax issues. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025.

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Fortunately the IRS has answered this question.

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

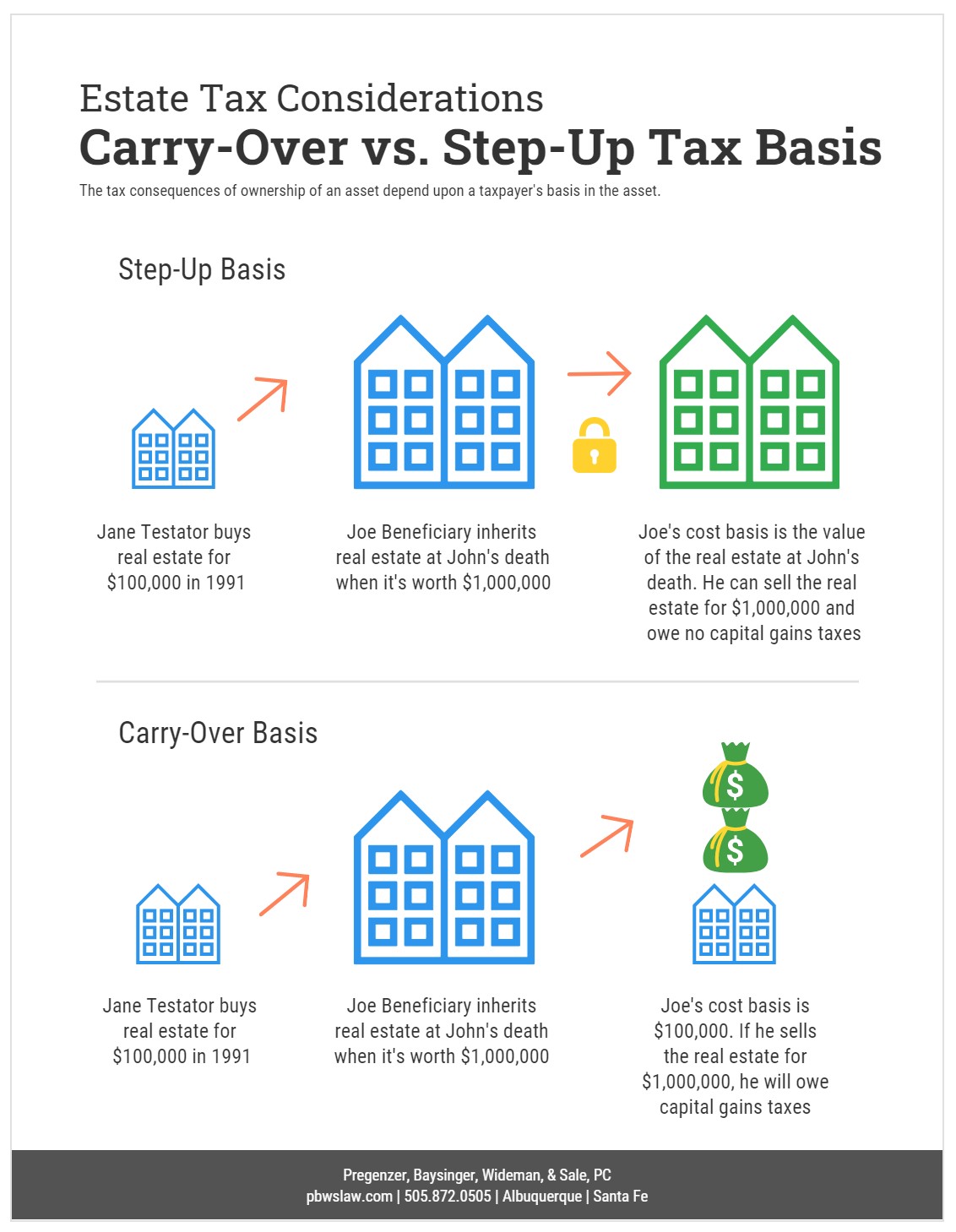

. The estate and gift tax exemption amount has increased from 117 million per person to 1206 million per person in 2022. Notably the TCJA provision that doubled the gift and estate tax exemption from 5 million to 10 million adjusted annually for inflation will revert to pre-2018 levels after 2025. The grantor of the trust has the flexibility to forgive the loan prior to the sunset date and complete the gift.

Importantly the lifetime gift tax exemption is tied to the estate tax exemption. The Sunset Provision of the Temporary Increase in Estate Tax Exemption. Starting January 1 2026 the exemption will return to 549 million adjusted for inflation.

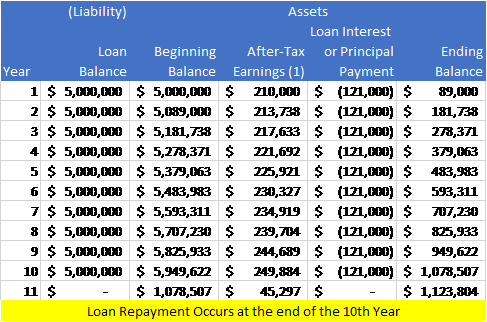

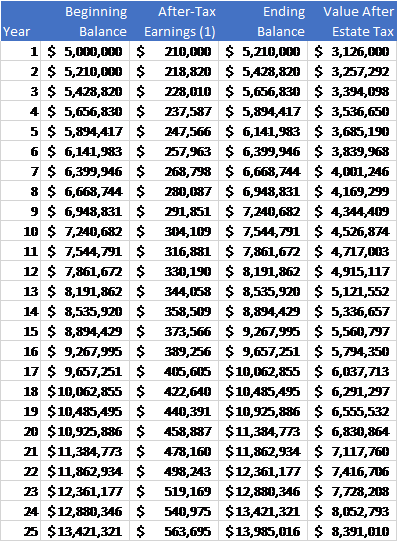

How Gift Taxes Work The annual gift tax exclusion is 16000 in 2022. That could result in your estate having to pay over 49 million in federal taxes leaving your heirs with about 1474 million in after- tax assets rather than 1964 million if you made the gift sooner. 31 2025 and will return to the Obama exemption of 5 million adjusted for inflation.

This sunset raises the question as to what happens if a taxpayer makes a taxable gift before 2026 when the threshold is 12 million or more but dies after 2026 when the threshold has been cut in half. It consists of an accounting of everything you own or have certain interests in at the date of death. For any amount exceeding the exemption you will be taxed at a flat 40 tax rate.

You can gift up to the exemption amount during life or at death or some combination thereof tax-free. You can gift up to the exemption amount during life. Absent any further legislation TCJA provisions will sunset at the beginning of 2026.

The maximum gift and estate tax rate is. The gift tax exemption and the estate tax exemption are effectively treated as a single amount. Nothing has happened politically and the doubling of the estate and gift tax exemption is scheduled to sunset on January 1 2026 at the end of the 7 th year.

Website builders As 2026 approaches families who have more than 10M or individuals with more than 5M may be served well from making more than 5M of completed gifts and utilizing the higher estate exclusions before they sunset. The separate annual exemption per donee for inter-vivos gifts is retained. Under current law the estate and gift tax exemption is 117 million per person.

Estate and Gift Taxes. The current exemption limit for estate and gift taxes is 117 million 234 million for couples as provided by the TCJA. Its important to remember that the current law will sunset at the end of 2025 at which point the amounts and rates will revert to those in effect in 2016 which are significantly.

The irs is also increasing the lifetime estate and gift tax exemption to 1206 million per individual for 2022 gifts and deaths. The estate tax is a tax on your right to transfer property at your death. Making large gifts now wont harm estates after 2025 On November 26 2019 the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to.

Visit the Estate and Gift Taxes page for more comprehensive estate and gift tax information. The federal estate gift and generation-skipping transfer tax exemption amounts are currently set at 1158 million per individual or 2316 million for married couples. This increase in the estate tax exemption is set to sunset at the end of 2025 meaning the exemption will likely drop back to what it was prior to 2018.

The adjusted exemption in 2026 is projected to be between 6 million and 7 million. The estate tax rate on the taxable portion of the estate if any is 40. Learn about the COVID-19 relief provisions for Estate Gift.

As the IRS released on November 22 2019 The Treasury Department and the Internal Revenue Service today issued. Transfers exceeding the maximum exemption are currently subject to a 40 tax. The current exemption will sunset on Dec.

On the contrary because of the scheduled sunset of current estate tax laws in 2026 you should read this article carefully if your estate will likely be worth more than half the current tax-free gift limit when you die. This lifetime exclusion also called a lifetime exemption is worth 1206 million in 2022. Under current law the estate and gift tax exemption is 117 million per person.

Additionally in 10 years the gift and estate tax exemption will have likely reverted back to the lower 549 million amount for dates after 2025. The exemption amount gets adjusted each year and if no change in the law is made it will increase to approximately 12060000 in 2022. Proper planning may be necessary to make sure you are taking full advantage of the current exemption and arent negatively affected when it decreases.

The Tax Cuts and Jobs Act in 2017 provides that the estate tax exclusion amount is 10 million adjusted for inflation through 2025 will revert back to 5 million adjusted for inflation for people. The current law is scheduled to sunset at the end of 2025 at which time the estate gift and GST exemptions will decrease to about half of their current amounts starting in 2026. However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action.

The exemption from the estate tax applies to estates and lifetime inter-vivos gifts in the aggregate. For 2022 the lifetime exemption is 1206 million. Reducing the Estate and Gift Tax Exemption Limit.

The Committees proposal accelerates this sunset and decreases the exemptions to approximately 6020000 per person or about 12040000 for married couples beginning in. The lifetime exemption is the amount you can gift across all tax years before you owe gift taxes. Said another way you should keep reading if your estate value exceeds 11580000 5790000 if unmarried.

Under current law the estate and gift tax exemption is 117 million per person. It is also indexed in 1000 increments and has increased from 13000. Although the vast majority of Americans have estates that fall under the estate and gift tax exemption the exemption is set to be cut in half in 2026.

With inflation this may land somewhere around 6 million.

2021 Federal Gift Estate Tax Exemption Update Sessa Dorsey

Do Qtip Trusts Help Avoid Estate Taxes Frankel Rubin Klein Payne Pudlowski P C

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Federal Estate Tax Exemption Sunset Is Not Far Off Merhab Robinson Clarkson Law Corporation

Impact Of Tax Laws Changes On Estate And Gift Taxes What You Need To Know And How To Act On It Now Credo Cfos Cpas

Will Vs Living Will Vs Power Of Attorney Estate Planning New Things To Learn Last Will And Testament

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Biden Administration May Spell Changes To Estate Tax Exemptions And Basis Step Up Rule

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

Life Insurance Trusts Offer Discounts On Estate Tax Wealth Planning Estate Tax Life Insurance

Recent Developments In Estate Planning Ey Us

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half Law Money Matters

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half